Finding standard terms for Employee Share Option Plans and Tokens can be overwhelming. In this living dictionary, Sprout provides some easy, “layman’s” definitions of key industry terms. We will cover everything – cap tables, ESOPs, tokens and more.

We will be regularly updating this page. If you have a term you are curious about, contact us at hello@getsprout.co. Our team will help you and we’ll cover it here.

Want to know more about how Sprout can help your organization? Talk to our team.

Pool or Employee Stock Option Pool

Firstly, the company will set aside a number of stock options for employees via an employee stock option pool. This typically starts a discussion at the board level and the amount can begin as a small percentage, such as a few percentage points, but can quickly expand to 5-10%. With subsequent funding, this pool can grow to exceed 15% and beyond, albeit a bit slower incrementally as the value of the shares increases. As stock options are granted, the available shares in the pool will correspondingly decrease. If options are cancelled, the cancelled options will return to the pool and this number will increase.

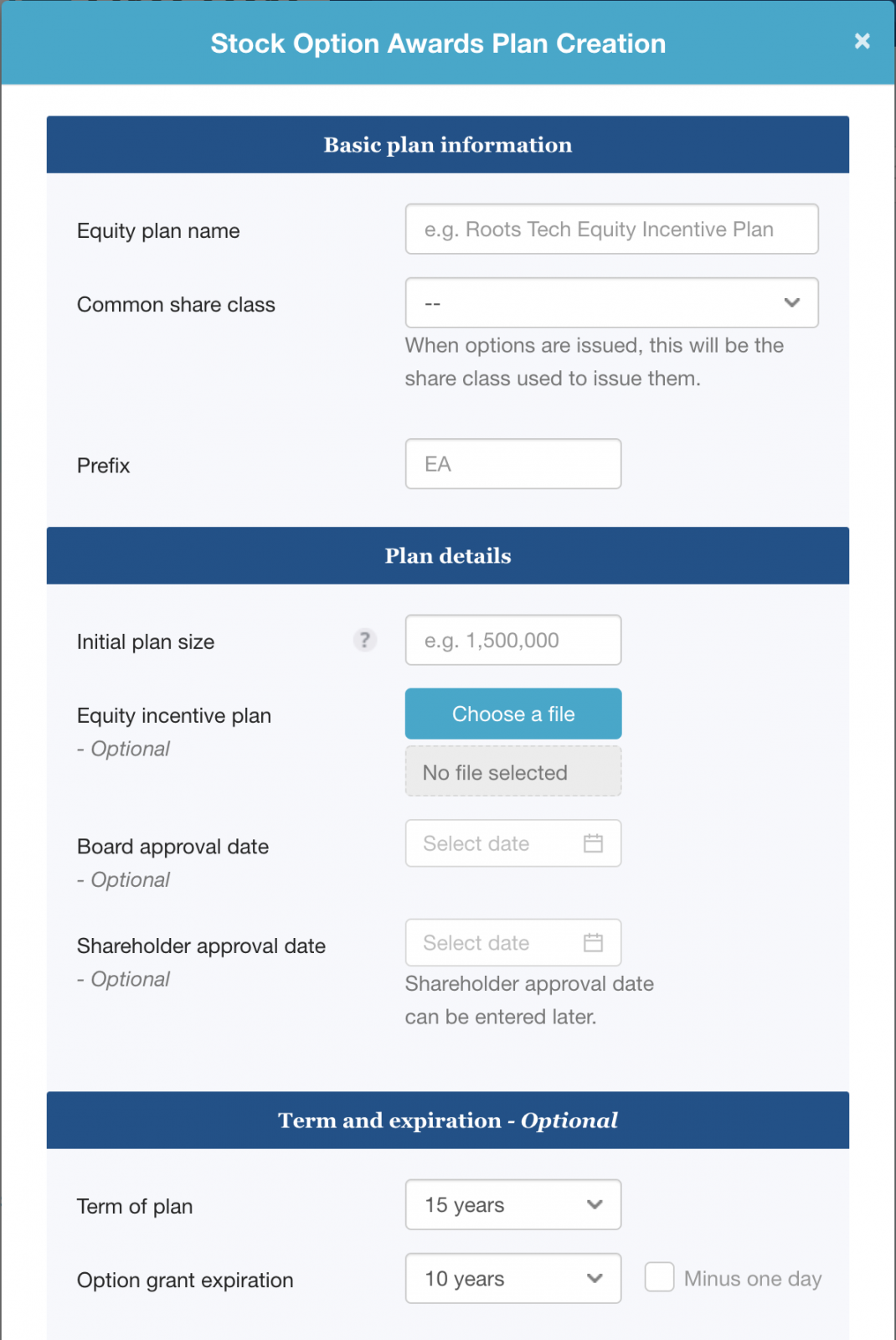

Term of plan

This is the period of time during which the plan will be in place. After a plan expires, no employees are eligible to purchase shares under the plan, and you will need to put a new plan in place for new and existing employees.

Grant

Employee stock options, or ESOPs are typically awarded to employees through what is known as a Grant. A grant represents the entire amount of options for the recipient and is usually provided in the initial employment offer. This amount is for the entire life of the grant, not just the first year of an employee’s compensation. Often grants are decided during the recruitment and offer process where the company should have a calculated range they can offer a prospective candidate.

A very common question for teams is to figure out how much equity to grant and this is where Sprout can help. This calculation should be based on the annual value of the shares granted at the time of the grant in conjunction with the cash and other benefits. A common misconception is equity should be based on some industry standard percentage of ownership, but this percentage should end up being the output rather than an input.

Option grant expiration

Typically, a share option plan will give your employees the option to purchase shares for a certain period of time. Employees must exercise their option during that period, after which the option expires. For instance, if you choose a 10-year option grant expiration, employees will have the right to buy shares every year, for 10 years.

Vesting

Stock option plans often describe the process of earning the right to buy shares – called Vesting. The amount of options which can be exercised is determined by how many options have vested.

The purpose of vesting is to prevent the distribution of options with immediate effect as the option holder’s relationship with the company could drastically change. This leaves the option holder prematurely departing with a significant amount of shares. This is a tool managers employ to ensure that key employees remain with the company for an extended period of time, ensuring time in which the business could grow with individual contributions.

Employees typically follow some time-based schedule, which outlines the number of shares an employee can purchase throughout their employment. A time-based vesting schedule will distribute options over an extended period of time.

Additionally Vesting then divides into smaller time-based units, such as monthly. In Silicon Valley, it is common to see vesting periods that stretch 36 to 48 months. Increasingly, performance or milestone-based vesting are becoming popular. Essentially, when an individual meets certain deliverables or conditions they receive these vested options. For example, a sales team receives vested options based on the number of sales targets they achieve.

Cliff

Companies commonly will further employ a “cliff”, or the initial waiting period before stock options vest. An employee must complete a set period of employment, such as one year, before their stock options kick in. This condition mitigates the risk of departure of a new option holder with vested shares should the employee leaves early.

For example: a 48-month vesting schedule with a 12-month cliff. This means the option holder would receive 25% of their options upon the completion of the cliff. As a result, managers and option holders should be aware of the approaching cliff as a substantial amount of options would vest at that time.

A standard vesting schedule in the US, employees must remain engaged for 1 year to vest 25% of their options. The remainder vests over the next 3 years.

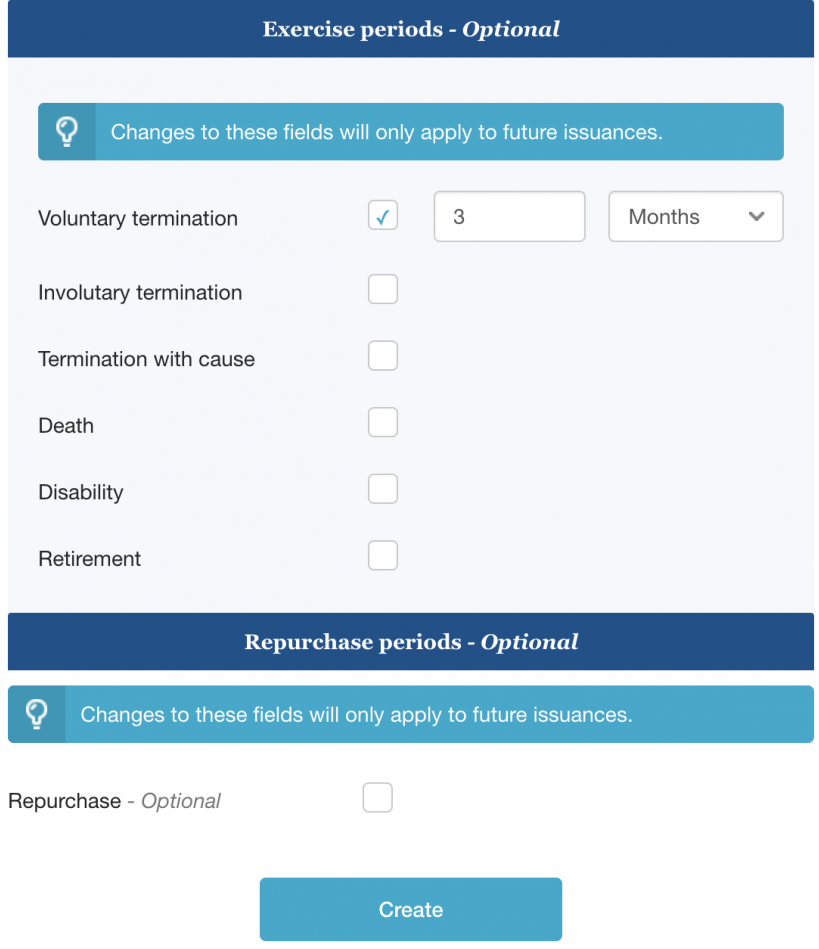

Exercise and exercise periods

Options provide the right, but not the obligation, to buy shares in a company’s stock. The act of buying of the shares when certain stock option conditions are met is referred to as Exercise. When an employee leaves the company, depending on the way they leave, they will have certain rights and a fixed time (known as the exercise period) to buy their shares. Typically, besides retirement, disability and death, exercise periods for employees leaving can be as short as one to three months. Any amount not exercised will again return to the ESOP Pool.

Exercise (Strike) Price

The Exercise Price is the price in which an employee pays for the right to buy each share. In the United States, this price is typically set at the then current price per share of the company, based on a fair market value and cannot be lower. In other markets like Hong Kong or Singapore, this price can be set very low, such as at $0.001 per share. Make sure you speak to your advisors to understand what you can do.