One of your biggest milestones as an entrepreneur is fundraising

Unintuitive at times, fundraising as an entrepreneur is just as much about what you shouldn’t do as what you should. Traditional, tried and true methods are a given, but the less obvious, experience-taught insights make all the difference.

Quantitatively speaking, the odds are stacked against you: for every 20+ introductions to a VC, you might get one term sheet if you’re skilled. You’ll make mistakes along the way, but with strategic thinking and some tips here, you can learn to master the art of fundraising.

Andy Lee, co-founder of Sprout, has extensive experience, with 20 years of experience as head of both mid-sized (Mapbox, Kabam) and large-scale (Uber Asia) enterprises in APAC. Fortunately, he enjoys mentoring and sharing with entrepreneurs to guide them to a winning position.

The following are some of the essential lessons from his journey for your fundraising process.

1. Magnetism

When you launch a startup, your mission (aside from producing the intended service or product) is to convince others to invest both time and money into your business, but they’re unlikely to do so unless they also believe in you.

Your ability to attract talent speaks volumes about your vision and executive competence.

The team you have built around you is crucial. Your team is a concrete measure of your magnetism. And not just regarding the employees; it’s about the co-founders, the evangelists, the advisors and early investors as well — really anyone you associate with.

2. Traction

A world-class pitch can carry a lot of weight, but many VCs will want to see data to back it up. They know that over the course of a year, the difference between a 10% and 20% month-over-month growth rate really equates to 3X and 9X growth respectively.

Steady growth won’t get you far enough; your goal should be steadily accelerating growth.

If a company with linear growth has proven their product-market fit, customers will be willing to pay. From there, if you demonstrate your ability to scale their business, you will have no issues raising money from investors.

Data has become an immutable source of truth to prove the viability and scalability of your business. You will need at least 6 months of consistent, measurable growth to generate and project trends from which investors can extrapolate.

3. Early Relationships

Ideally, you don’t want your fundraising pitch to be your first meeting with the VC. In fact, the more time you’ve had to build that relationship, the better you’ll both understand whether the match is right.

Founders often overlook the time these relationships take to build. An effective technique is connecting on a messaging app like WhatsApp or Wechat for quick, casual conversations. Another tactic to building relationships is being thoughtful and present by sharing related news or wishing them happy holidays. It’s like most relationships in life – they don’t work if they’re purely transactional and communication only takes place when you want something. Rather, when the VC asks you questions, immediately build up credibility by following up with thoughtful, detailed responses. To speed things up further, consider keeping a repository of general questions to pull from.

One of your biggest milestones as an entrepreneur is fundraising

Andy Lee — Founder

Believe it or not, each relationship takes around 15 months of preparation:

- 6 months to get to know each other, introduce the business and give the VC time to survey progress

- Average of 3 months to close

- Begin fundraising discussions with at least a 6 month runway

- 6 + 3 + 6 = at least 15 months to start your fund raise.

Pro tip: a great situation to be in is what we call a “non-fundraising fundraiser”. This is when you are able to simply tell your story without asking for money, allowing for a more relaxed communication with investors. Take every opportunity you can to just meet investors, share and get feedback.

4. Cap Tables and Equity

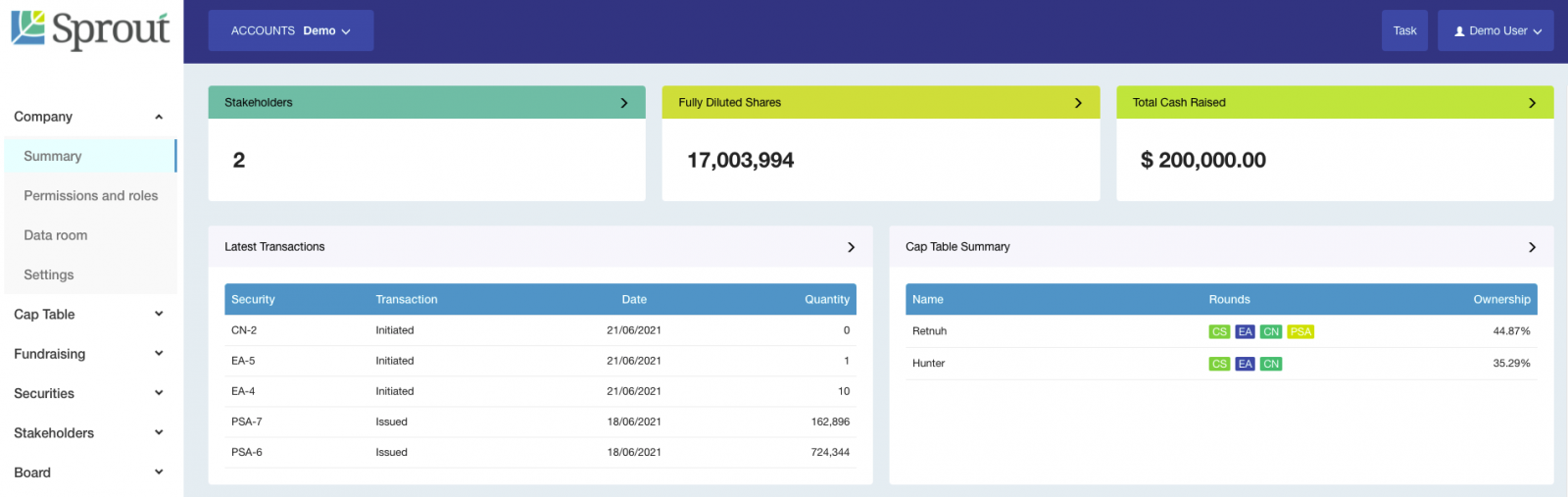

A cap table is typically a list that shows the full equity split of your startup. It becomes locked upon receipt of your first external investment when investors join your cap table, so it’s important that you figure out a few fundamental elements beforehand, the first being co-founder equity.

The rule here is simple: don’t split it equally. That may not sound fair, but think of it this way: everyone’s time commitment and market values are different. If you split equity ownership equally, someone is inevitably getting some portion of a “free ride” while someone else is unfairly compensated.

We know you’ll want to play around with different arrangements before the cap table is locked, which is why Sprout provides a co-founder equity calculator to let you test things out.

As a founder, you’ll want to explore employee stock options plans (ESOP) as long term employee retention and incentive tools. ESOPs are traditionally distributed over a 4 year period in places like Silicon Valley, but can take up to 7 years to vest in places like Beijing. Luckily, the Sprout team is well-versed in these geographical differences and is capable of customizing your ESOPs data dependent on where your company is located.

5. Momentum

During fundraising, you want to create a feeding frenzy around your business. But how do you get others excited? In short: momentum.

Much like with traction, you can project a sense of momentum by intelligently managing relationships. Part of relationship management is your ability as a founder to set and exceed goals and expectations. In other words, setting targets that balance the achievable with the surpassable.

A common misstep is when founders say something like: “We’re going to sign a big deal with X”. Often things don’t go according to plan or the deal ends up being less profitable than anticipated, so it’s better to wait until you have signed X, then use that fact to your advantage.

Pete Flint from NFX characterizes this as finding the “minimum viable excitement”. Set the most achievable, yet momentum-building goals you can find. When you exceed them, you create the over-achieving image you want your investors to see.

Final Thoughts

Treat fundraising like a job interview. It’s good to show domain knowledge, hunger and drive.

Be prepared and carry yourself with confidence because it’s just as much about you as it is about the business. If the first meeting goes well, you will be invited back for more meetings.

Just like an impressive candidate will ask impressive questions, you should also be asking questions to determine if you fit their investment thesis and if they will be a good supporter of your business. Do ask questions such as how many investments they’ve made, how many they make a year, or how many exits they’ve had. What is the process like and how long does it take? It is even fair to ask for references, as they may ask the same of you. It may not seem like it sometimes, but investors will also prepare in advance for your meeting. If you are a blazing hot startup, its entirely possible when meet they may put a term sheet right in front of you in the first meeting.

Finally, as an entrepreneur, you can and should allow yourself to be impatient and demand things from your potential investor. As Andy says: “It’s ok to be a little bit of a jerk.” The investor needs to understand that your time is valuable, you will not accept bad terms and that you will walk if they aren’t met.

Want to know more about how Sprout’s product can help your company? Contact us at hello@getsprout.co for a free one-on-one consultation session today.

Or read our blog on How to Set Up ESOP for Your Company’s Success to learn more about how ESOPs can help your company.